Urgent Sage 100 Payroll Fix for 2022 Year End Processing

January 11, 2023

by Jared Bollier, Digital Marketing Analyst

Take action before performing Payroll Year End Processing if possible Deduction Codes will have balances reset after Payroll Year End Processing

There is an issue with a new payroll feature added with Payroll version 2.22.3 to have the Reset Deduction at Year End apply to all Deduction types, not just pension deduction types. This field is defaulting to Y and should have been defaulting to N. It specifically affects non-pension deductions that have a limit and may have undesirable data results if the field value is not changed to N before processing Payroll Year End.

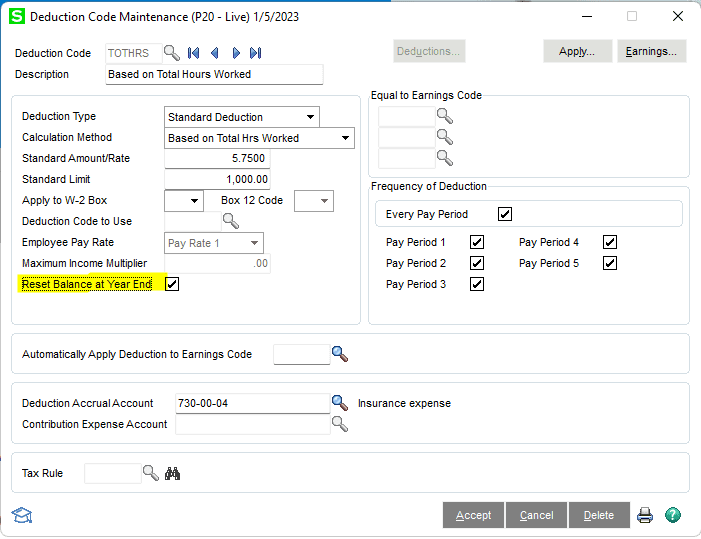

Functionality of the Deduction Code Reset Balance at Year End check box:

- Select this check box to retain employee deduction records, regardless of whether or not the limit or goal is reached for the deduction code/year. If the option is enabled in deduction code maintenance when year-end processing is run in payroll, then the amount in the Ded. Balance field is reset to the amount in the Ded. Goal field in the Deduction Detail drill-down window in Employee Maintenance, deductions tab. Clear this check box if you do not want to reset the deduction balance at year end.

- Note: In Employee Maintenance, if a deduction has no remaining balance for the current year, it will not rollover and populate deductions tab for employee in the new payroll year when year-end processing is run. If a deduction code has a remaining balance for the current year, then it will rollover and populate deductions tab for the employee in the new payroll year at year end processing per above (setting goal equal to this remaining balance). If the Reset Balance option is enabled for the deduction when year-end processing is run, the balance will reset to match the goal amount for the current year being closed, then rollover and populate the deductions tab in the new payroll year.

Actions to take based on your situation:

If Payroll Q4 2022/Year End processing hasn’t been run yet:

- If Payroll Q4 2022/Year End processing hasn’t been run yet, it’s important to take action before that is done. Review all deductions and for any non-pension deductions with deduction limits and uncheck the Reset Balance at Year End box if you don’t want those reset so they will act like they always have before. The feature added with PR 2.22.3 was supposed to default to N and was defaulted to Y.

- Below is a screenshot of the field.

If you have not yet run year-end, read How to reset deduction balances at year end for instructions on how to verify that your settings are correct.

If you have already closed Q4 2022, but haven’t processed a 2023 payroll yet:

- Review non-pension deductions to determine in 2022 before year end processing was performed if any of non-pension deductions had limits in 2022 either by going to a copy company if one was created before closing the payroll year, your knowledge of your deductions, and/or review of the Deductions report and Check History report for 2022.

- If there are non-pension deductions with limits or you aren’t sure, then the best action is to restore payroll from the backup the day before the payroll year was closed. Be aware of any employee changes/new employees and new or changed tax rates, deductions, earnings, etc. since that backup will need to be re-entered. Determine based on how much work has been done since you processed year end if it makes more sense to restore from backup or to follow the steps below under if a payroll has been processed to correct the affected non-pension deduction balances.

- Once the backup is restored then refer to the information below for unchecking the Reset Balance at Year End box for any non-pension deductions with a limit that the balance should not be reset. Then process Q4 2022/year end processing and re-enter any data added after the original year end processing.

If you have already run year end and deduction balances were incorretly reset, read Reset Balance at Year End incorrectly defaulting to Yes for some Deductions for information about correcting your balances.

If you have closed Payroll Q4 2022 and have processed at least one 2023 payroll:

- Review if any non-pension deductions had limits in 2022. If none had limits, no action is needed. You may still want to review your deduction codes and uncheck the Reset Balance at Year End box if the deduction may have limits in the future or if limits for the deduction are entered by employee.

- If there are any deductions that had limits in 2022 review the steps above for identifying which deductions had limits, which employees, and what the limits and remaining balances should be for 2023.

- Using the information, correct the deduction code limit and uncheck the Reset Balance at Year End as applicable in Deduction Code Maintenance.

- Using the information, deduction balances will need to be corrected manually in Employee Maintenance/Deductions tab. Calculations will need to be made to calculate the correct remaining balance (if any) that should have rolled over.

- Review if adjustments are needed for any of the deductions on the employees’ next checks.

If you have any questions or want our assistance in this matter, please reach out to info@dsdinc.com